Transforming African Finance Through Securitization: Innovation, Sovereignty & Impact

If you are:

- a finance, banking, or investment professional seeking to understand the new financing levers shaping Africa,

- an entrepreneur, project owner, or business leader looking for innovative and adapted sources of funding,

- a policymaker or public-sector actor involved in economic structuring and development financing,

This free masterclass is for you!

👉 This free episode is made for you !

ABOUT THIS EPISODE

Across Africa, financing needs are rapidly increasing—whether for infrastructure, SMEs, agriculture, energy, or social development. Traditional tools are no longer sufficient.

Securitization is emerging as a strategic lever to mobilize local savings, attract international capital, and finance large-scale, high-impact projects.

This masterclass will take you inside the vision of an expert who has built financial solutions bridging Wall Street and the West African Economic and Monetary Union (WAEMU). You will learn how securitization transforms essential economic needs into solid, credible, and attractive financial products that support sustainable development across the continent.

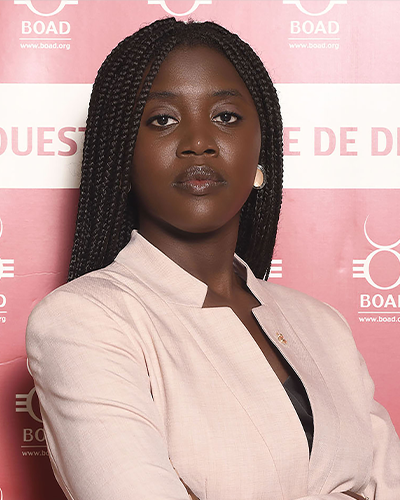

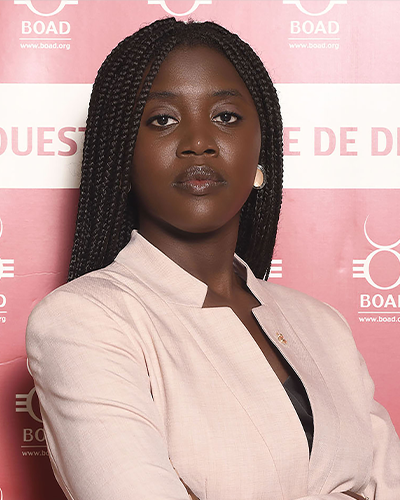

Our Guest Expert

Adji Sokhna Mbaye

Adji Sokhna Mbaye, Managing Director, BOAD Titrisation, with nearly 15 years of experience in global financial markets, she is one of the leading figures of African financial engineering. She previously worked at top-tier institutions such as Merrill Lynch, Natixis, Citi, and Morgan Stanley, where she led complex quantitative strategies and developed systematic investment indices (QIS). Today, as Managing Director of BOAD Titrisation, she structures and oversees securitization funds designed to finance WAEMU’s strategic priorities connecting financial markets with real, on-the-ground economic needs.